The Different FIREs (Coast, Barista, Lean, Fat)!

Being a finance nerd, when I hear the word “fire” I think you are talking about the “financially independent and retiring early” movement. I know…there is something wrong with me (don’t worry, I’m aware lol).

For those in the unknown, the FIRE movement is to lower your need for active earning to live your desired life and take control over one of the most valued things in the world…” time”.

Everyone has a different reason for joining the movement. Not everyone is trying to retire and live out their days sailing the world on a mega yacht by the age of 65.

Some people are looking for peace of mind they’re on the right track, to move to a less stressful job, to take a calculated risk on a dream, or just retire in the traditional sense.

Like most personal finance topics, there are different levels of FIRE that appeal to different people which we’ll be going over. Even if you are looking for that traditional retirement, it’s fun to know the milestones you are crossing along the journey.

FIRE (“Normal Retirement”)

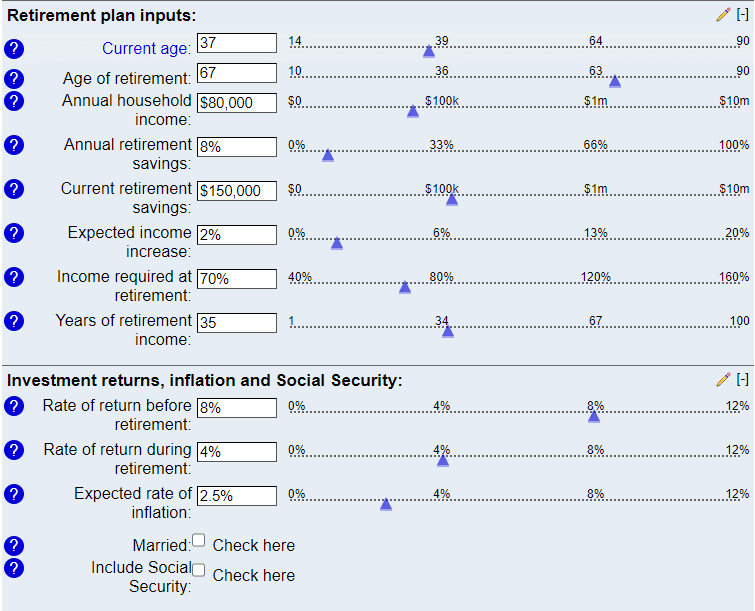

To understand if you are hitting the other levels of FIRE, you first need to understand what your desired retirement living standards are when you retire. The industry standard is to have 25 times (4% rule) your desired income saved up in retirement.

This is the part where everyone’s number may differ as everyone has different lifestyles. If you are curious about what an average number would look like, we can reference a recent Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics (BLS) showing the average monthly expenses for American households are $5,111 ($61,334 per year).

That means a targeted number would be around $1,533,350 (25x rule) in retirement accounts to retire (not factoring in things like social security). The 25x rule does assume around a 30-year retirement, so if you are expecting to retire much sooner this would need to be adjusted.

What’s the normal retirement age?

When the Social Security program was created in 1935, the normal retirement age was set at 65. In 1983, at the time of the last major amendments to Social Security, Congress gradually increased the retirement age to 67 for workers born in or after 1960.

The average retired worker receives $1,559 each month ($18,708 per year).

People are living longer with modern science! The slow increase in age required to get full social security benefits makes sense as they aren’t trying to run out of money (hopefully they don’t run out before I retire 😊).

You could include that number into your calculation if you want, or just plan for the worst and assume nothing from social security (and whatever you get is just a cherry on the top) to be conservative.

So, on average someone is looking to acquire around $1.5 million by 67. Great! We have some targets, but something we need to consider is inflation. $1.5 million today is not the same as $1.5 million in 30 years, unfortunately.

Depending on the assumed inflation rate and the amount of time till retirement, you may need to tweak your numbers.

This is where using a retirement calculator is helpful to get more precise with calculations depending on your own needs.

This is where most people stop thinking about FIRE, but finance nerds have created different levels of FIRE (sounds like a video game where you need to beat a boss to move on to the next level lol). Each level unlocked means different things, but each level passed is one step closer to “normal” retirement.

Coast FIRE

You did it! The first level of financial independence is unlocked!

Coast FIRE is when you have enough saved and invested that with no additional contributions, your net worth will increase with compounding growth to support a traditional retirement.

What does this mean? It means you don’t have to stress as much about contributing money to investment accounts to achieve your goal. Of course, this isn’t foolproof because it uses an estimated investment return rate. If for whatever reason your actual results differ, then you could come up short (but there is that risk in every category of FIRE).

I would say this category is more of a stress reliever level.

Are you constantly worried about retirement even though it is 30 years away? If you have already hit this number, you shouldn’t worry as much and try to celebrate your achievement.

Another benefit of this level is that you could switch to a lower-paying less stressful job.

For example, you have a job that pays $100k/year but you are constantly stressed out and working a ton of hours. Why are you killing yourself (in the mental and physical sense) if you could move to a lower-paying job ($70k/year), but with a better work-life balance?

Most people would say “are you crazy? Leave a higher-paying job?”. Again, this is a personal decision, but knowing that you don’t have to have the pedal to the metal regarding saving for retirement is good to have in your pocket when you are losing sleep over a job.

The kicker here is the lower-stress job still needs to cover all your current expenses, you can’t suddenly hang out playing with puppies all day for minimum wage if that doesn’t cover the bills😊 (that’s my dream job).

Here is a coast FIRE calculator, to check out to see if you’re already there!

Barista FIRE

The name barista fire comes from the fact that you have reached a number where you don’t need a higher paying job to support yourself and your retirement savings are big enough, they can be withdrawn a little bit to cover your lifestyle while still working and letting most of the investments compound.

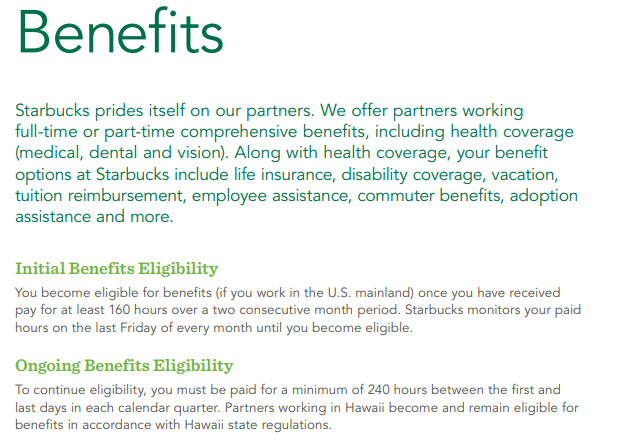

Why barista? Well, this came about as employers like Starbucks offer benefits to those that meet certain requirements.

People have the expectation a job as a barista is lower stress, but if you work at a busy location, I don’t necessarily want to be working during those rush hours! Or dealing with the stress of mispronouncing people’s names! No thanks😊

Of course, the barista is just one job, but this FIRE level is any job that gives you some benefits and pays to be able to support yourself and has a more flexible schedule (but then again, some places may force you to work weird shifts or weekends which could be seen as dealbreakers).

This level is also for people that maybe are in retirement and want some extra spending money or are bored and want to do more of a fun hobby job.

Lean FIRE

Now we are getting into the bigger camps of FIRE people.

Lean FIRE For those that want to approach the problem of financial independence from a minimalist, stoic, frugal, or anti-consumerist trajectory.

At this FIRE stage, you have enough money to cover the basics of living, but you don’t have a ton in the sense of being able to spend on the niceties of big vacations or eating out all the time.

I see three types of people in this camp, those that are frugal, open to relocating geographically, or those that want to take a leap of faith into a dream job (or take bigger employment risks in general).

If you are frugal, you can live on less than your average expenses in the US (or wherever you live). The issue is if 10 years into lean retirement you decide that you want to spend more, then you would have to go back to the job marketplace (which may be a rude awakening). Also, there is much less room for assumptions in returns or spending to be off (as there isn’t padding for variance).

One way to increase your purchasing power is to move to a cheaper location in the world and live out retirement there. That isn’t for everyone, especially if all your family is in another more expensive location. It may be harder to visit family or come back after a longer period.

The last camp of people is those that now can take bigger risks with employment without immediate compensation. So, if you wanted to start a business from scratch, you know your basic living requirements are covered and you don’t have to worry about instantly turning a profit. You could take a job that has equity but a very low salary.

At this stage, you have more options. End of the day, that is what FIRE is about…” options”.

After this level, you would hit that “normal” retirement stage that we discussed earlier.

Fat FIRE

You’re looking for that big “F U mega yacht money” (or maybe a smaller boat with more realistic expectations). The kind of money where on a bad year in the markets, you don’t even blink or think about adjusting your retirement lifestyle because you have put additional padding around your nest egg.

How much is that exactly? Depends on how lavish you want to live!

Fat FIRE is about having a bigger than average retirement fund to be able to live a higher lifestyle when you retire.

It can also be a way to pad your “normal” FIRE number and again have less stress about running out of money (for those that are overly conservative). So, if you need $2 million, but have $2.6 million you’ll be able to do a 3% withdrawal rate if the 4% withdrawal rate makes you nervous.

This group is about retiring and not having fewer restrictions on spending habits.

Conclusion

If any of those FIRE classifications resonates with you and want to learn from other people’s experiences or be around like-minded individuals, each group has its own Reddit group.

Retirement is one of those topics that may not be on your mind daily, but it’s still good to have a pulse on the overall direction you’re going.

If you haven’t thought about it at all, it may be good to start. It’s better to have some plan than just be oblivious to it all and hope you win the lottery! 😊

If you enjoyed this article and want to learn more about personal finance topics, make sure to check out our free personal finance courses!