9.6% Guaranteed Returns?! I Bonds Explained

Everywhere I go on the finance side of social media, I see people talking about I bonds.

“GET 9% GUARANTEED RETURNS!”

“YOU’D BE AN IDIOT NOT TO TAKE ADVANTAGE OF THIS!”

Like everything else in finance, there are pros and cons that need to be discussed before you FOMO into bonds (even though there is a limit on how much you can invest in these, but we’ll get to that 😊).

What Exactly Are These Financial Instruments (I Bonds)?

Definition: “A series I bond is a non-marketable, interest-bearing U.S. government savings bond that earns a combined fixed interest rate and variable inflation rate (adjusted semiannually). Series I bonds are meant to give investors a return plus protection on their purchasing power.” – Investopedia

I get the appeal with inflation being so high (last CPI report of an 8.5% increase year over year for March), the rates on these series I bonds are at higher levels than in recent history.

The initial interest rate on Series I savings bonds bought through April 2022 is 7.12%, but that percentage changes every 6 months, and May 2022 will bring new rates.

Experts are expecting the new interest rate to come in around 9.6% (May 2022 through October 2022).

These I bonds look pretty good in a world where 8%-10% in the stock market is the average long-term return, high yield savings accounts pay around 0.5% and checking accounts offer essentially nothing.

Here are some other important highlights:

- Considered a lower-risk investment because they are issued by the US government.

- 30-year maturity, but they can be redeemed after 12 months (penalty of three months of interest if redeemed earlier than 5 years of holding).

- You can buy paper I bonds (up to $5,000 each year) and electronic I bonds (up to $10,000 each year). The total allowed per eligible person is a combined $15,000 each year.

- Federal taxes are due on interest earned (only when redeemed) but no state/local taxes.

How Does the Interest Work?

So, the I bond accrues the interest monthly and compounds on a semi-annual basis.

What does this mean exactly?

Let’s say you are getting a 12% interest rate on a $1,000 investment.

After 6 months you would have $60 of interest.

When it gets compounded after 6 months your new principal is $1,060 (interest gets rolled into the principal) and for the next 6 months, you get $63.60 of interest instead of $60 (if it’s still a 12% rate).

In total, you end up earning $123.60 in interest instead of $120.

Of course, the interest rate itself changes every 6 months and it may be easier to think of it as an interest rate you are getting for half a year.

The I bond is split between a fixed rate (which never changes after you lock it in) and a variable rate (based on the inflation data which does change every 6 months) and uses the following formula to come up with your rate:

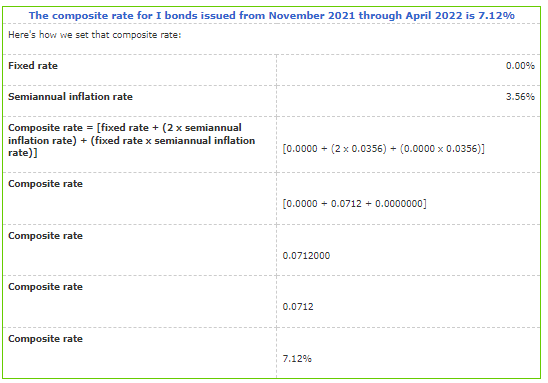

Composite rate = [fixed rate + (2 x semiannual inflation rate) + (fixed rate x semiannual inflation rate)]

Here is an example from the latest composite rate of 7.12% for bonds issued between November 2021 and April 2022.

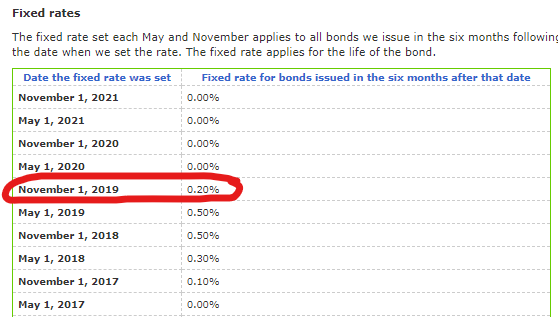

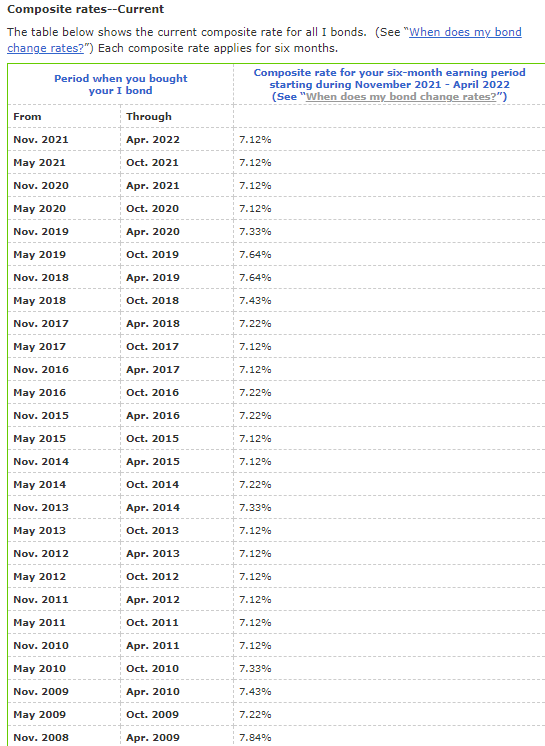

Even though the semi-annual amount is high, the fixed rate is currently 0%. There hasn’t been a fixed rate since 2019.

You’ll see how the bonds bought in these higher fixed rate environments are more valuable because they get the same variable change, but the fixed rates don’t ever change.

If you time-traveled back to 1998, your I bond composite rate would be 10.64%!

It’s clear that most of the return for these bonds comes from the variable rate and if the inflation rate is low then the return on these bonds is going to be minimal.

Don’t think you can just load up on I bonds now and keep that higher rate forever 😊.

Also, don’t worry if we have a deflationary period, the inflation rate may be negative, but the composite rate will never go below 0% for the I bond. It’s been a while since that’s happened but good to know!

What Are the Drawbacks?

The first thing that comes to mind is opportunity cost. If inflation is higher and the stock market has had a drawdown, there is a chance that taking a $1,000 and putting it in the stock market may result in a higher return over a year. Of course, that isn’t guaranteed, but it’s possible.

Another downside is liquidity. If you need the money now, it is locked up for at least 12 months. That means putting your entire emergency fund into I bonds may not be the best move.

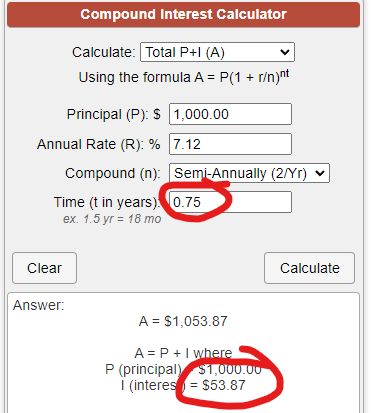

The last one would be the early redemption penalty. You lose 3 months of interest if redeemed before 5 years. So, with a 7.12% rate and if you redeemed after 12 months you would end up with $53.87 in interest on a $1,000 investment (or a 5.39% gain). While it sucks to take a penalty, It’s still better than a 0.5% annual rate in a high yield savings account.

How to Buy I Bonds

Paper I bonds (paper savings bonds will be mailed to you) can only be bought indirectly through a tax refund of up to the $5,000 through IRS Form 8888.

This is per tax filing not per person’s SSN like with the electronic version. You can also put the paper I bonds in someone else name as a gift (but that person can’t go over their own personal limit of $15,000 for that year because of the gift).

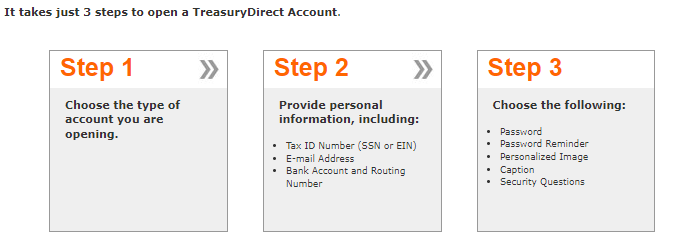

Electronic I bonds can be bought on TreasuryDirect for anyone that is a US citizen (even if abroad), US resident, or civilian employee of the US. You can also buy for those that are under 18 in your own account. It’s simple to set up the account.

If you are asking if there are fees? There aren’t any to open the account or to have securities in the account (no maintenance fees).

Once opened, you can keep track of all of your electronic treasury securities in that account (treasury bills, notes, bonds, TIPS, FRNs, I bonds, EE bonds).

Conclusion

Would I rather own stocks or these I bonds?

Since I’m younger and more aggressive with risk, I would pick stocks every time myself (something like an index ETF like “SPY” over I bonds).

The reason being is you could be too slow to redeem your I bonds and move over to stocks if you are trying to time the market (if the stock market has a massive rally over a couple of months you could lose all the relative gains you had).

I think it can make sense to utilize these bonds if you have a larger emergency fund stuck in a high yield savings account and you don’t need the liquidity for an entire year.

Even with a 3-month penalty, you can still beat out the higher yield savings accounts.

In the situation where someone has more than 12 months’ worth of an emergency fund in cash or high yield savings accounts, rolling extra money into I bonds makes sense.

It can also make sense for those that are extremely risk-averse but don’t want to just sit on cash.

Anything is better than sitting on a pile of cash while inflation eats away at its purchasing power!

Tag:bonds, i bonds, i bonds explained