3 Ways to Prepare for a Stock Market Crash!

Every other day we hear that the sky is falling and the stock market is going to crash! Well if you say that long enough, you’ll probably be right!

The downside of staying out of the market though, is that you miss the upside returns and the power of compounding returns.

So how often do these pullbacks or crashes happen? See below.

In the entire history of the stock market, every time there is a pullback it has eventually recovered. So the whole “buy the dip” does have merit!

Of course that is if you are buying the entire market via the S&P 500. Buying the dip on a failing business or individual stocks may not result in it eventually bouncing back to all time highs.

In a recent weekly newsletter I talked about some ways you can protect your portfolio during a pullback, correction, or crash (however you want to phase a down move). I wanted to dedicate a whole post to this topic and go a bit more into detail.

We will talk about the scenarios in order of difficulty to pull off and complexity (starting with the hardest).

Hedging (Hardest)

If you have ever heard of the saying “time in the market, vs. timing the market”, there is a reason it exists. You can have all the indicators in the world, but predicting the exact top to a market with precise timing is difficult.

Some reasons behind the difficulty is that the market can just keep going up regardless of logic or maybe it stays flat while earnings and financials catch up to valuations.

Nonetheless, hedging can protect your portfolio if you do happen to time a pullback and is one of the ways to generate alpha in the portfolio (as you can make money on paper while everyone is losing). The strategies and products below allow you to make money when the stock market falls.

Inverse ETFs

The first option to hedge and most straight forward is to buy products that make money when the market goes down. One example of this would be SH which is an inverse ETF for the S&P 500. So if SPY goes up 1%, this goes down 1% and vice versa.

As you can see from the chart, shorting the market over a long period of time is a losing game. You don’t want to bet against the economy improving along with outside forces that can move the market up over time regardless of businesses improving (inflation or quantitative easing). So shorting is usually done on shorter time frames to protect against short term down moves (less than a couple years).

Something else to pay attention to is that expense ratio (0.9%). Since the product is more complicated, it has higher management fees that can eat into returns over a longer duration holding period as well.

You can also have leveraged products that magnify the moves in the ETF (2x or 3x). If you want to juice up the return of a small down move in the market, these can do that (of course that is a double edged sword if the market goes up instead).

Most of these inverse products exist for indexes vs. individual stock protection (that is where options come into play).

Here is a site that lists a ton of different inverse ETF options.

Options

You can use more complex strategy like a long put option to protect yourself from downside moves. With this strategy you are betting that the market or stock falls within a certain time frame. You put up a certain amount of money known as a premium as a sort of insurance policy for a down move. You can buy these insurance policies for a week, a month, a year, etc. The more time you want to hedge, the more expensive the option will cost you.

With options though, there is more complexity in terms of making money if the market or stock goes down. Due to the time value of the contract, you can be correct in direction (moving down), but you can still lose money due to the time value going down (if the move doesn’t happen instantly) or if volatility contracts (options are more expensive during times of high uncertainty or fear).

If you are scratching your head as this is the first time you are hearing about options, make sure to sign up for our free options course to get a deeper understanding.

Portfolio Allocation (Moderate)

Economic Cycle Adjustments

This one requires a little bit of knowledge on how macroeconomics work and how the fed can impact the economic cycles with their policies (either quickening the cycles or prolonging them).

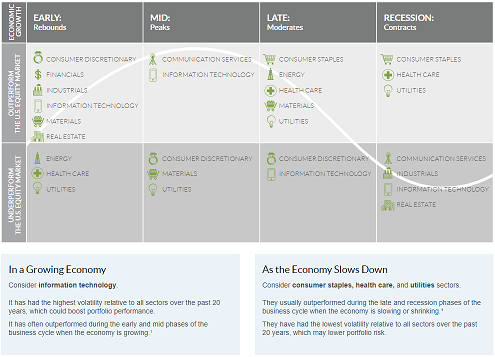

Fidelity has this great chart showing which sectors of the market perform well in the different cycles of the market.

If you believe you know which cycle we are in and where we are headed, you can shift the allocation of the portfolio to those specific sectors that will do well and go underweight on the sectors that may perform poorly. Again this is market timing and easier said than done.

You’ll see me do this a little bit in my own portfolio for my weekly purchases. I will look at my sector exposure and sometimes start to focus on one sector and companies within it if I believe there is a catalyst for that sector coming up over the next year and may out perform the overall market.

What I don’t do is shift my entire portfolio across sectors as I don’t want to chop myself up with being too active in the portfolio. I’m not about to sell Facebook (FB), Google (GOOGL), and Microsoft (MSFT) just because the business cycle may favor utilities. Those tech companies are still growing and have amazing free cash flow.

Company Type

Outside of sector rotation, you can implement diversification of types of businesses you own in the portfolio. You can implement stock categories like legendary investor Peter Lynch in which there are 6 stock types: Fast Grower, Stalwart, Slow Grower, Cyclical, Asset Play, Turnaround.

Similar to the above sector rotation, some of these stock categories can do better during a downturn and others perform better in time of expansion. I tend to put most of my money into Stalwarts (blue chip stocks) and Fast Growers regardless of the cycle, but may shift the % across buckets depending on where I think the market is headed in the shorter term (less than a year).

I actually made a Tik Tok on the differences between the types as well.

Age Dependent Asset Allocation

As we all approach retirement and already have substantial amount of money in our retirement portfolio, it makes sense to start taking less risk. Let’s face it, we don’t want to be about to retire and having 100% of our investments in penny stocks that could double or go belly up. There just isn’t enough time to recover in a reasonable way (20+ years). Although people can think stocks only go up, you just want to avoid that black swan event that can wipe out a big chunk of the wealth you built up.

You are on coast mode, so you are just trying to make sure you can live the lifestyle you want and not run out of money before you die (sorry that’s a bit morbid but just the truth lol).

That is why you hear people talk about shifting to more income or less volatile assets (bonds or stable dividend stocks). You can use a formula like the following to think about your asset allocation.

100 – Age = Stock % and the rest goes into Bonds

If for example someone is 30, that means they have a 70% stock and 30% bond portfolio. That may be a little conservative for some, I personally like using 120 instead to be a little more aggressive (but that’s just me).

Strong Personal Finance Habits (Easy)

This category is essentially the “do nothing different” section. Once you build solid personal finance habits and are confident in your ability to bring in an income and live below your means, then you no longer worry about down moves in the market. Why? Because if your investing timeline is long term (20+ years) then those down moves represent great times to buy into the general stock market.

Budgeting and Investing Consistently

How can one improve something that you can’t measure? You need to be able to see where the money is going to understand how you can take some of it and redirect it to investing in order to grow your wealth.

The topic of budgeting is not sexy. Regardless, I believe this is the reason for where I am today financially. Granted, being an accountant in the past courses through my veins and I get enjoyment from a solid budget. I know I’m weird!

The reason I bring up budgeting, is once you establish how much you can invest each month without sacrificing too much (I’m not one to preach pinching every penny and making life miserable), you can feel detached emotionally to the volatility in the market.

This detachment from money in the market is a behavioral finance advantage. If markets are crashing and people panic because they are losing money, you don’t care as much because you know you don’t need that money to live. So what do you do? Nothing. You continue as usual and buy assets at a discount that over a long enough time period will recover and continue to grow.

Having an Emergency Fund

The one thing that can put a wrench in the above scenario is if you lose your income source. That is why a second defense is the emergency fund. This would be enough money saved to get you through 6-12 months of not having an income.

This allows you to sleep better at night and gives you enough time to find another source of income.

Conclusion

One of my favorite quotes one of my prior managers used to always say is “keep it simple stupid” or KISS. Sometimes the best strategy is the simplest. I tend to put the most weight and focus on personal finance.

When I hedge my portfolio, it is usually on a relatively small scale (something like short positions in my options portfolio). The biggest form of market timing I implement would be portfolio allocation based on where I think the market may be headed over the next year (looking at stock categories and sectors).

Hopefully you can know feel like you know your options, the next time you see a scary clickbait title calling for a market crash. You can hedge, adjust your risk in the portfolio, or just carry on and not give into temptation to click on that video/article.