Effects Russia-Ukraine Conflict Has on Crypto

How has the Russian-Ukraine conflict been affecting crypto, and what can we expect moving forward?

On February 26th the EU barred seven of Russia’s biggest banks from access to SWIFT. This is a big deal!

And although it has already been talked about a lot in the news, I want to address the effects this will have and how these sanctions have impacted the crypto market last week. I’ll also discuss how this conflict will affect crypto potentially from a regulation point of view.

SWIFT Ban

Many of you probably remember February 28th when Bitcoin closed the day up 17%, the second-highest in the last 12 months. Good news for crypto, right? Well, it’s not so black and white. While it’s true that part of this gain was a result of Russia buying Bitcoin due to a variety of internal factors, many are making a bear case here by saying that crypto is Russia’s way to avoid sanctions from Europe and the West. I’ll examine these observations and make a case for why crypto isn’t Russia’s loophole, and why the rotation of Russian wealth into crypto is positive from a macro perspective.

First, let’s start with a detailed discussion of what these financial sanctions are, and why they’re worth talking about. The world imposed harsh economic sanctions against Russian banks and oligarchs on February 24th, to punish Russia for invading Ukraine. But there was one punishment that experts say was particularly severe – barring Russia from the SWIFT international payment system. SWIFT, or the Society for Worldwide Interbank Financial Telecommunications, is a communication system standard that is used by different countries’ central banks to communicate with each other. This ban would harm the country’s banks and harm their ability to trade internationally.

With the SWIFT ban, the value of the ruble fell in relation to USD (which is down over 30% on the year) and put overseas assets at risk for both the Russian government and the oligarchs. We’ve seen yachts, real estate, and even shell companies get seized from Russia’s richest (and even from Putin himself) as whole governments start to step up the freezing and annexing of Russian assets.

The extent to which oligarchs and even many run-of-the-mill Russians are rotating their money into crypto is unprecedented. They want to avoid the financial Armageddon that President Putin started in the country – and many have said they’ve seen the purchasing power of their Rubles tank by the day. In combination with the indefinite closure of Russia’s Moscow stock exchange, it’s hard to say if this was the cause of the recent Bitcoin rally. But that plotline is exactly what much of the faithful crypto community is suggesting. While the rally may or may not have been directly caused by an influx of Russian money, many traders front-running this scenario played a huge role in pushing that narrative. Either way, this leads to a big public relations problem that many of the traders suggesting this are left to explain.

Is Bitcoin an Effective Sidestep?

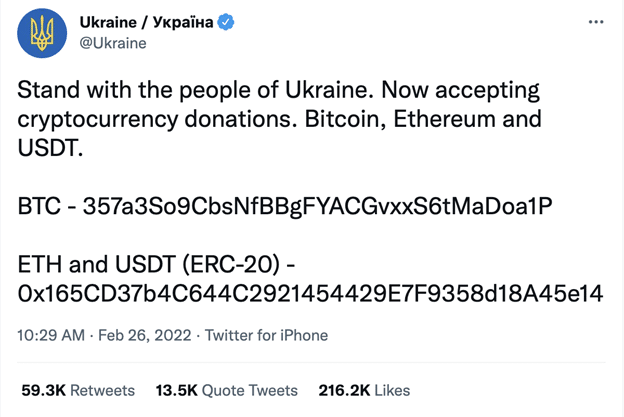

On the other side of this conflict, many have heard about the government of Ukraine officially accepting crypto donations to help them fight off the Russian invaders. However, these efforts aren’t enough to counter the argument that crypto is being used by Russia to sidestep sanctions. To play devil’s advocate, imagine if instead of Ukraine it was a terrorist organization doing the same soliciting of crypto donations.

This opens up a wider argument of the freedom of money, and whether it should be people’s right to donate their money to whomever they want- whether it be a national government or a terrorist organization. I would say that while it should be people’s choice, the “centralized” aspect of crypto can be used positively to stop the monetary freedom Bitcoin promises to bring from being a possible weapon in the wrong hands. Yes, crypto is decentralized in nature, and back when Bitcoin vending machines were the only way to buy and sell the currency it was truly anonymous and without a governing body. But times are different today: To buy bitcoin on an exchange, many require KYC (know your customer) verification to confirm your identity. And even if your exchange doesn’t? Chances are, you have linked a credit card or bank account to it, which links to your name anyway. Out of this paradox stems a term called “Dirty Bitcoin”, something we don’t hear much of today but is an important topic to touch on.

Every Bitcoin is trackable. Every coin has a unique 21-digit address, and all transactions are visible on a public blockchain. If a Bitcoin was known to be linked to an illegal transaction, exchanges, brokers or anyone who knows anything will never accept them. However, the term has an even broader definition now, where many true “anons” will not accept transactions that contain Bitcoin that can be traced back to ever being held on an exchange. Why? Simply because those are no longer decentralized and can easily be linked or traced to a name.

Bringing this back to the question of whether Bitcoin has a use case of sidestepping sanctions and embargoes: because every Bitcoin’s address can be tracked and most people today use centralized exchanges like Coinbase to buy and transfer crypto, it would be very difficult but not for someone to anonymously donate to a terrorist organization, just like donating with cash.

Russia using crypto in regards to trade would also have some of the same issues of traceability once certain accounts we’re established as owned by the Russian government.

Potential Regulation Changes

I watched an interview with Hillary Clinton talking to Rachel Maddow about how the Russia – Ukraine war has brought urgency to the need for a regulatory crackdown on crypto and how it’s threatening the reserve currency status of the US Dollar. This “threat” is something that crypto aficionados have long been dreaming about – switching the global reserve currency away from the inflationary dollar and into the fixed supply crypto that is Bitcoin. Yet with many countries keeping Russia on high nuclear alert and the West leveraging control of the fiat currency system as their best hope of pacifying Putin, many may argue that it’s a matter of being careful what you wish for.

Moving forward, it’s my view that we will see steps being taken by governments to crack down on the potential threats crypto poses, but this regulatory clarity may not be such a bad thing: they are simply doing what they can to stop the possibility of crypto being used in a bad way, something that we all should support. Of course, there is some hypocrisy here considering fiat currency can do the same sort of damage they are trying to accuse crypto of doing. So while Russia’s wealthiest may be rotating some of their savings into crypto, it’s important to remember that, unlike cash, crypto is traceable and that this may be for the better.

Written By: Benjamin Goroshnik – MSW Contributor

Tag:bitcoin, btc, crypto, cryptocurrency

Leave A Reply

You must be logged in to post a comment.

1 Comment

Thank you! Very insightful.