ELI5 Impermanent Loss (Yield Farming)

Today, we’re looking at something common in the DeFi space and trying to eli5 impermanent loss to you! If you’re involved with yield farming and staking liquidity provider tokens, this is something that will be valuable to you because it’s good to know that it exists.

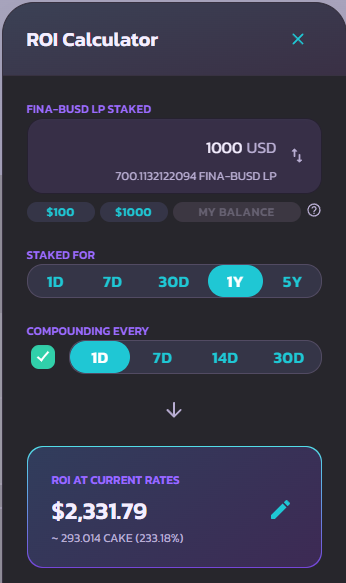

It’s the reason you’re possibly going to see lower rewards than is expected when you look at a website like pancakeswap or whatever decentralized exchange you’re using where they show you a projected APR percentage.

For those of you that are doing single token staking or lending, you may be wondering, does this affect you? No, it doesn’t, but it is good to see when you’re comparing the opportunity cost or the possible ROI of single staking versus liquidity providing and make a more informed decision by knowing which one is better for you.

Binance has this great article that goes into detail about impermanent loss, but the main takeaway is that the loss comes from the token prices changing over the period of time you are providing liquidity. So the more that the token prices change, the bigger the impermanent loss will be.

When you provide liquidity provider tokens to a liquidity pool, it’s usually a 50-50 split. Meaning if you’re depositing $200, you’ll need a $100 worth of token “A” and a $100 worth of token B. The amount of those tokens are going to be dependent on the initial prices.

Let’s go over this example where Alice deposits 1 ETH and 100 DAI (stablecoin) into a liquidity pool. when she does that, the value of 1 ETH is $100. Now over time, if the price of ETH changes while you’re providing liquidity, that’s where the impermanent loss can happen.

If you’re confused, that’s totally normal. I was super confused about how this worked until I saw a couple of examples and was able to wrap my head around it.

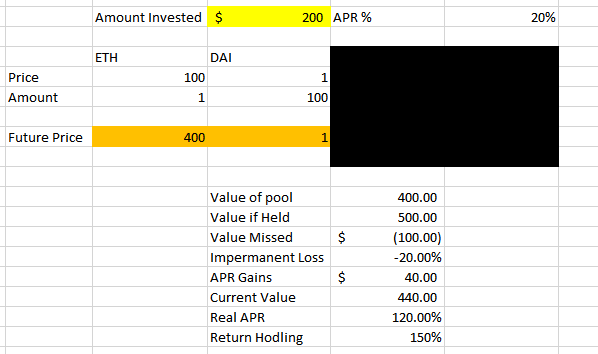

So let’s go over an example in Excel. Hopefully, this helps visualize it a little easier to digest!

So we have the $200 as the initial investment, the ETH at $100, and let’s say the ETH went to $400. That’s a pretty big increase in price which will cause that impermanent loss to show up.

The whole point of impermanent loss is comparing the value of the liquidity pool versus if you had just bought the cryptocurrencies (in the pairing) and held them. If you just bought ETH and DAI for $200 (split 50-50) and just held, what would it be worth? You can see the value of the pool of $400. The value of holding would have been $500. The value missed is the impairment loss. That’s the whole point is understanding the change in price ratios and how that affects the total value of the pool.

We have to remember though, that the reason people even provide liquidity is to get a certain APR percentage (expecting rewards). So if you get 20% on this initial $200 investment, your APR gains would be $40. And the total value of your liquidity pool, plus the APR gains would be $440 in this situation. It would’ve still been better to just hold onto ETH but of course, that’s a pretty big increase in the price of ether.

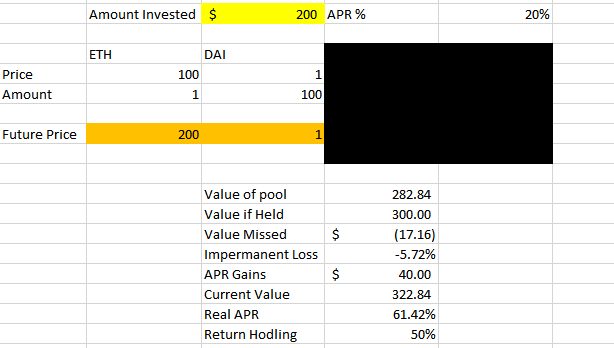

Let’s say if ETH just went up to $200, all of a sudden your current value for providing liquidity after a year would actually be higher than if you had just held onto the 50-50 split of the initial cryptocurrencies.

This is why it’s important to understand this impermanent loss because a hundred percent increase in ether is only a 5.72% loss versus that giant increase to $400 creating an impairment loss of around 20%.

If you’re wondering how I came up with that calculation in Excel, to figure out the liquidity pool value after year, don’t worry. I’m not that smart. It’s coming from this article explaining the constant product formula, how that works, and how you can actually figure out the value of that liquidity pool after a year.

It’s all about the price ratios of the tokens changing. Here’s a quick cheat sheet on the price changes and how much loss it would equal.

It’s also good to remember that it doesn’t matter the direction that the price of these tokens is changing whether that is up or down. If the price ratios are changing, it’s gonna lead to impermanent loss.

Hopefully, your main takeaway so far is the more volatile tokens in the pairing means the higher the impairment losses can be. Having a stable coin in the pairing can reduce the impermanent loss. Whereas, if you have two shit coins that are constantly going up 90%, down 75%, then going up 500%, your impermanent loss can be on the larger side.

To counteract that issue, usually, the APR and the rewards for providing liquidity for that crazy volatile pairing are much higher.

If you wanna know what I mean, go to pancakeswap, and look at the APR percentages, looking at something like CAKE-BNB at 35% APR or BUSD-BNB at 16% APR.

If we sort by something like APR, you’ll see that GMI B fin a B U S D. These APR percentages are way higher, 167%. That’s insane, right?

But the question is what the heck is FINA? I don’t know! It’s probably some very low cap coin that’s volatile, and that’s why you’re getting paid a higher percentage because of that possibility of impermanent loss. The liquidity of this token might go down over time if the project doesn’t catch on and kind of goes away. So this APR percentage brings you into the project because it’s high, but it can lead to losses if there are big changes in the price ratios.

The estimated APR % is going to show you everything related to the current pricing of that token. It’s the current LP rewards, and that’s where you can get yourself in trouble.

The nerd that I am, I wanted to create a calculator that factors in those changes in token price over a year, the APR percentage and shows what the potential ROI would be. I did just that. I know it’s a little bit of a plug, but I got excited and built my own DeFi Impermanent Loss Calculator.

You’ll need to put the amount invested, the protected APR %, token “A”‘s value, token “B”‘s value, and what the reward token is priced at, you’re going to put future token prices as well (you get the idea if you go to the calculator itself😊).

Using the FINA-BUSD pairing as an example, If token “A” (which in this example is FINA) went from $0.31 to $0.10, token “B” is a stable coin (BUSD So it’s gonna stay at $1), your projected APR is 167%, and assuming the same price for the reward token at $8 (CAKE)…you would still be up 123% for providing liquidity.

You’re much better off providing the liquidity to make those rewards in this situation where the price of FINA falls dramatically.

If FINA exploded in price going to $6 from $0.31 (this is all hypothetical) then your ROI for holding would’ve been 917% versus only 506% for providing liquidity.

If you have projections for prices, or if you wanna put in tokens that are a little bit more stable, and aren’t gonna be so volatile, you can play around with this calculator to see the summary and an ROI comparison.

Now just because you can provide liquidity, it’s not always the best scenario for total returns. If you’re looking at something like CAKE, maybe just staking CAKE (as a single token) and getting the governance token, would be better if you’re just holding onto CAKE tokens and want to compound that amount of CAKE over a year (regardless of the possible change in the price of CAKE).

For a liquidity pair like CAKE and a stable coin, there may be a lower ROI instead of just doing the single token staking (where you’re not even dealing with impermanent loss)!

So it’s important to compare when you’re deciding what to do with your cryptocurrency when getting involved in the DeFi space. Is it even worth it to be a liquidity provider?

Hopefully reading this article gives a little bit more clarity on what impermanent loss is. If you’re more confused than ever, I’m sorry, I failed you!

Maybe it will click if you read through other articles or play around with the calculator.

If you did get an important takeaway from this article and want to learn more about cryptocurrency, make sure to sign up for one of our crypto courses!

This article was generated from the following Youtube Video: