Helium Mining Profitability in 2022 (Is It Still Worth It?)

I often get the question. Is it worth it to still get into helium mining? How is the helium mining profitability?

AKA – Can I still make a bunch of money?!

I’ve been mining helium for around eight months. So I understand the ebbs and flows, the pros and the cons of helium mining. I’m not trying to say no matter what, you should be buying a helium minor, that doesn’t make sense! It depends on a lot of things.

In this article, we’re going to take a realistic approach to whether or not it makes sense to get into helium mining. If you’ve watched my previous youtube videos or read my previous articles, you know, that I’ve made an Excel spreadsheet to help me understand the profitability of helium mining.

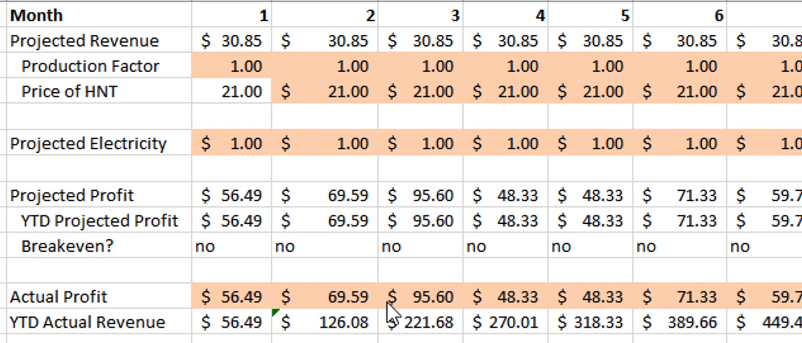

As for my own results since I got started the actual profit coming in after around 8 months has been around $450 in total. Now, when I purchased my bobcat 300 miner, I bought the base unit, an ethernet cable, and a new antenna/mount. My total upfront was around $610.

I’m expecting in the next 3-5 months, I’ll break even on my purchase of the miner (which in traditional finance metrics is pretty solid). You’re talking about a pretty much 100% ROI within 12 months. I’ll take it!

If you’re reading this as a brand new person to helium mining you don’t care about my past results, you want to know “is it still worth it”?

So I’m gonna use a couple of assumptions to try to help guide you to an answer. Let’s assume that you’re buying a bobcat 300. After taxes, shipping, and taxes it comes out to $526 bucks.

If I look at my own earnings, I’m making around 0.04 helium per day, but the average earnings on the network are around 0.097 helium per day. The average daily production is a big factor in your profitability. The amount of helium that you’re able to generate in your area will determine whether or not it’s a good potential ROI.

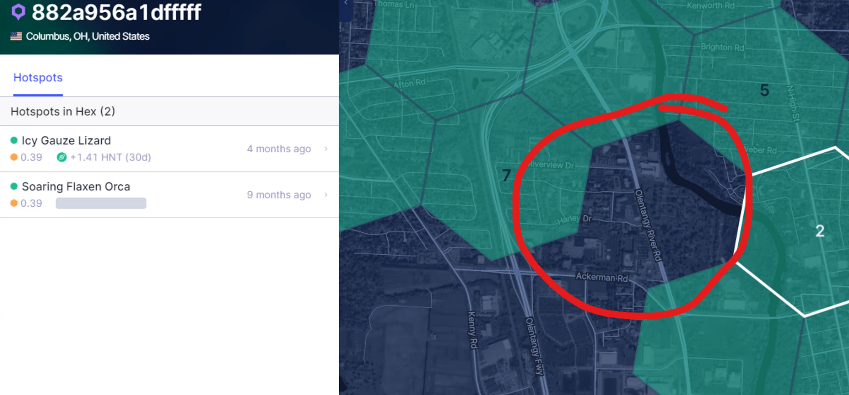

If you’re wondering how the heck am I supposed to know what my average earnings would be? You just go to the helium explorer, click into the area that you live in, and just see what other helium miners are making.

For example, just picking these random miners in a randomly selected location, this helium miner is making 1.41 HNT (over 30 days) while this other one is making 1.76 HNT (over 30 days).

If you’re gonna set up a miner in this area, you can assume that’s around what you would make in HNT/day for an average setup. Plug your assumptions into an ROI calculation to figure out what’s acceptable.

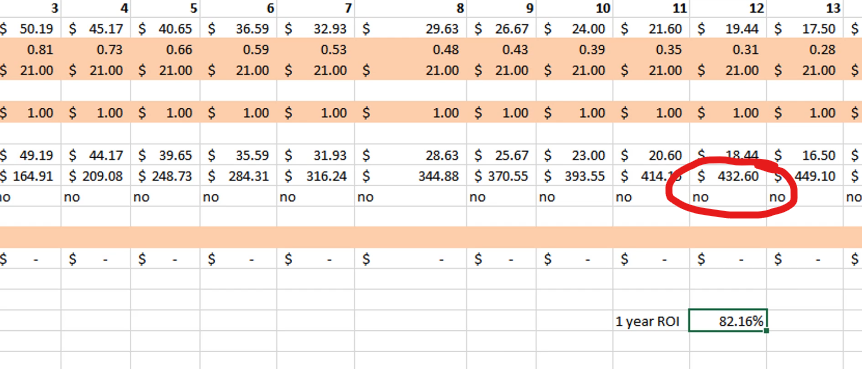

For this example, we’re going to start with the average earnings of the network and then play with the numbers at the current price of helium, which is around $21. The first month has a projected profit of around $61. The thing is with helium as more miners come online, the profitability of everyone goes down (especially if the price of helium doesn’t go higher). In order to calculate the reduction in production you may face on a monthly basis, I looked at the past 30 days of miners coming online. I saw that the amount of online hotspots has increased by around 10%.

So the reasonable assumption is your production would go down around 10% every month going forward. If the price of helium stays the same, you don’t have data charges and electricity stays low (helium uses proof of coverage so it uses maybe a $1-$2 of electricity each month) but your production is going down the profits each month would fall too. Overall though, you would still have an 82% ROI (which again from a traditional standpoint is great).

I think the important takeaway here is what is it worth for you to set all this stuff up? If you’re ROI on this whole project is 10% after putting in your own inputs. Is it worth it to go through all the hassle, buying the miner, setting it up, dealing with troubleshooting, all that stuff we’re talking about to make an extra $400 bucks a year? That’s based on the average numbers. If you’re not okay with that, that’s where you would say, it’s not worth it.

That’s kind of middle-of-the-ground conservative estimates. The price of helium has to go up in order for the profitability to stay elevated at the same as the first month. The question is, where is the equilibrium for people to stop mining? 100% ROI (12-month months to make all your money back and you still have the miner)? Are we talking about everyone racing towards 10%?

At 10%, you could invest in a stock like AT&T and get a 6% dividend and literally click a”buy” button. You don’t have to do any of the set up or have to worry about figuring all this cryptocurrency stuff out (if you aren’t familiar already). If your earnings are starting off much lower than the average, (let’s say you’re in my spot where the earnings themselves are 1.34 HNT for 30 days) you’re looking at a one-year ROI from this point of around 38%.

My personal cutoff would be anything less than 30%. While 30% is good, we have to remember there is setup and troubleshooting.

If I’m spending more than a couple of minutes on it in a month and making like $5 a month then I wouldn’t even get involved (that’s like a couple of McDoubles). That McDonald’s value menu money!

I would say if you’re watching other YouTubers or bloggers still hype up helium like it is a money-printing machine. I’d be a little cautious…

I think the heydays of making $2,000 per month from your helium miner are not coming back. The project is too well known. Early on helium was a new concept and excitement about the project pushed the price of helium higher. This was before the halving when the amount of helium that was being distributed each month was much higher.

Something else to keep in mind is the lead time. If you ordered today, a lot of these miners are still on backorder. So if you go to a website and it says, it’s gonna take a year, you should also factor that into your potential ROI and earnings.

I know this may be disappointing for some that are maybe just getting their miner, but I’m trying to be realistic with my projections. Personally, at a point where the miner was only making $4/month, I would probably sell my miner (which based on my location has lower than average earnings) to someone else that had average to above-average earnings.

If you are bullish on helium still and you think the price of helium is going higher, it may be better to buy HNT than straight-up buying a miner. This is when the yield is calculated to only be 5%-20% for your own location. The reason being is you would get a faster payback at that point and be able to liquidate a bit easier versus having to sell a miner.

We will have to see how it all goes down, and I feel like a big piece of the profitability puzzle will come down to the price of HNT rising as there is no evidence of miners coming online slowing down!

If you did get an important takeaway from this article and want to learn more about cryptocurrency, make sure to sign up for one of our crypto courses!

This article was generated from the following Youtube Video: