Bumble Inc. (BMBL) Stock Analysis

Company Profile

If you have ever had the lovely experience of online dating you probably have heard of bumble. The unique angle with the app is that women are the ones to initiate conversation which is different than most apps that allow either party to start chatting.

From my own personal experience I would say bumble is a top 3 dating app (hinge and coffee meets bagel are the other 2).

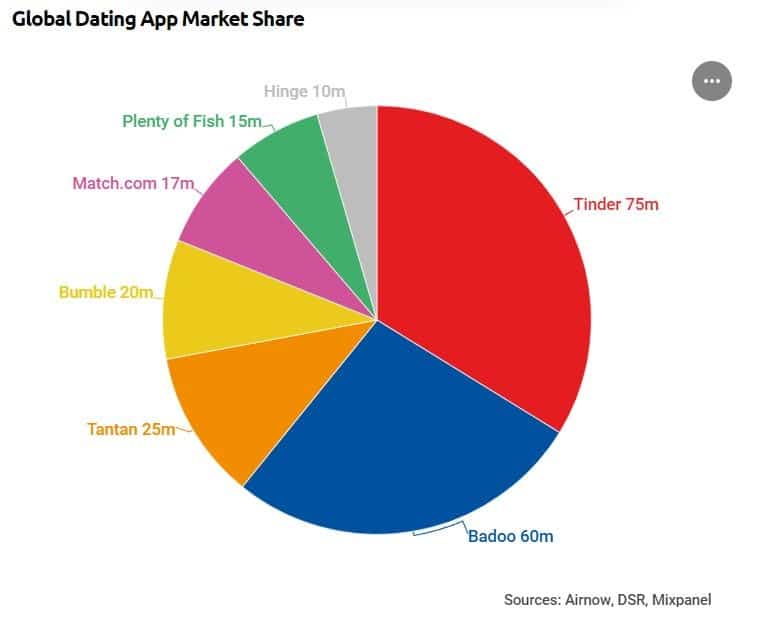

Now this company isn’t only bumble, they actually also have Badoo (which I never have heard of myself), which is more popular internationally.

What’s interesting is the bumble app also has a business and friend feature, but I feel like the real money maker is being a virtual match maker.

I actually have lot’s of friends that have found their current boyfriend/girlfriend (or now husband/wife) through dating apps. I know it is fun to bash on online dating, but the trend is that it is here to stay and is more of the norm to meeting people.

Stock Profile

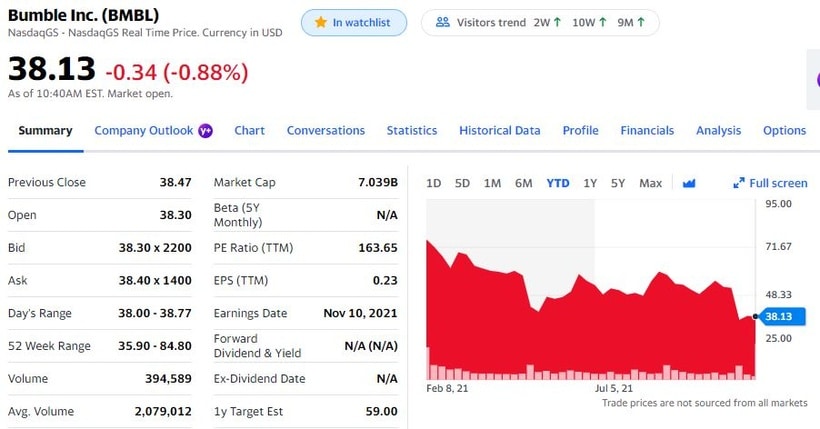

The company itself has only been trading publicly since February of this year when they had their IPO. It came hot out of the gates, but has down trended over the year. Which is often something you see with IPOs especially the ones that came out right when the markets were really frothy for speculation/growth.

After the latest earnings the stock has dropped to 52 week lows. At a $7 billion dollar valuation though, this is the type of mid cap company that at the right valuation and growth could be a nice multi bagger over the years.

Macro Environment

With the pandemic, online dating did get a big bump in demand with even more distancing that usual and meeting up at a bar was less likely with the local restrictions.

The trend of online dating though is expected to continue to grow as seen by the below graphic.

While the growth isn’t crazy, it is around 7% going forward on an annual basis. Of course higher growth can be achieved if an app or website has a better experience and can take market share away from it’s competitors.

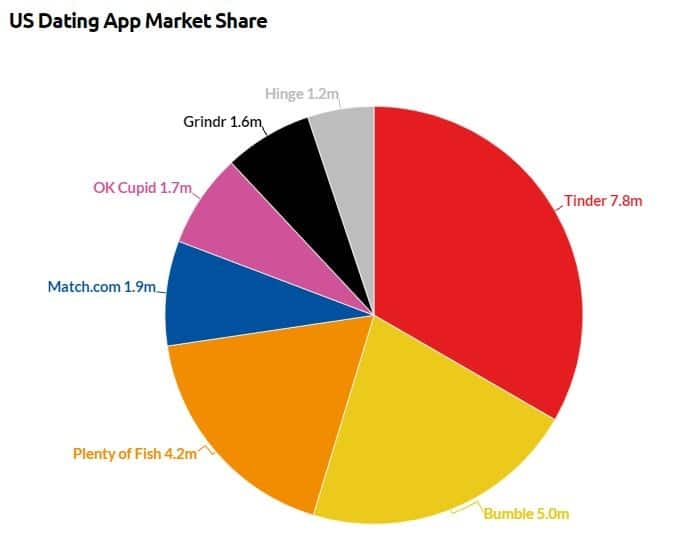

Speaking of competition, that is the one downside of the dating app ecosystem. I actually have both BMBL and MTCH on my watchlist and Match actually has a larger diversification of apps (Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish, and OurTime), but we will be comparing the two companies.

But with that said, bumble does make up a large and growing portion of the US market (which is the most profitable segment).

Also since the barrier to entry is low (creating an app) there is new contenders that come up, but the difficult part is differentiating the product. If there is a unique feature or algorithm, that is when it may gather users. But without a strong presence of users a dating app will obviously not have much use and die out.

Financials

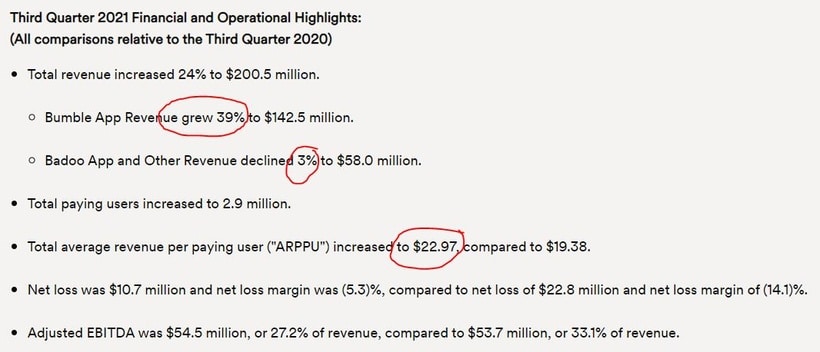

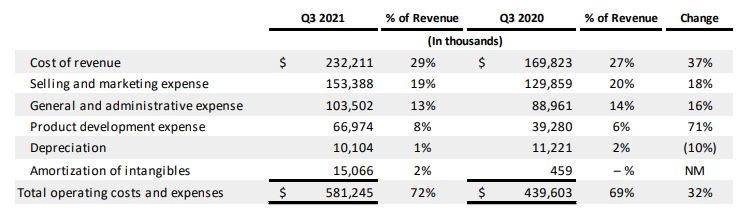

When it comes to the numbers there is two main points that I see in the numbers. Bumble seems to be carrying the whole squad (Badoo shrank YOY) in revenue growth while the cost of operating has increased for the business vs. last year.

If we further look at the operating metrics we see that the user growth is once again in Bumble and the reason that the average revenue per paying customer rose for Bumble again. So clearly bumble is doing something right across the board.

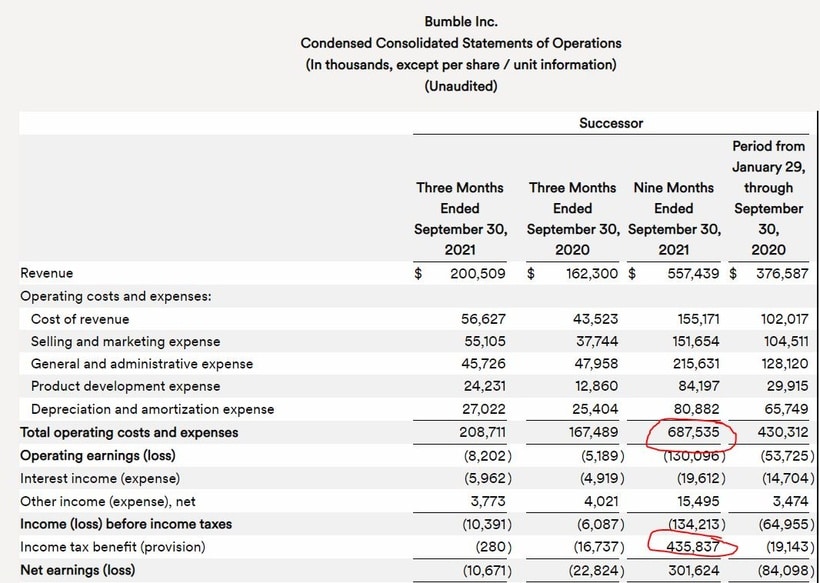

Once you dig into the income statement we see that while the revenues are rising the company is still operating at a small loss for the quarter and it seems like cost for specific areas are rising.

As a percentage of revenue

Cost of revenue – 28.2% vs. prior year of 26.8%

Selling and marketing – 27.4% vs. prior year of 23.3%

Productive development expense – 12% vs. prior year of 7.9%

I think if they wanted to the company could swing to profitability, but I think the focus of this company is to innovate and continue to amass users via higher marketing costs. The company is generating free cash flow (although a relatively small amount).

I also wanted to highlight that the reason they are showing net income YTD is because they have a huge $435 million tax benefit, which I would ignore as the stock market is forward looking and that’s a one-off.

Overall their adjusted EBITDA margin did increase slightly for the first nine months of the year going from 26.3% to 27.3%.

Match Group (MTCH) Comparison

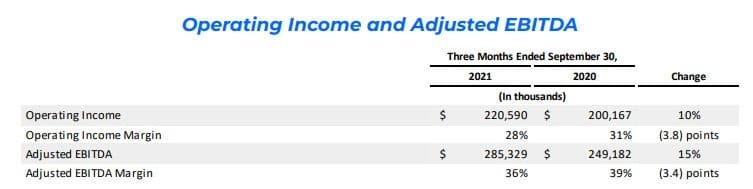

Just to see how different these companies operate at, I wanted to look at some high level numbers for match group. Match grew revenues 25% YOY driven mostly by the success of Tinder and Hinge. They also talk about testing AR/VR and pushing a new experience in the metaverse.

Overall their growth is slightly higher, their portfolio more diversified, and their margins are established based on the size of their revenues. With that the company does trade at a higher multiple though (which makes sense).

But match also gives us insight into what bumble can become as it has a higher ceiling compared to the already larger match group. If bumble can scale the business, they too would see probably similar margins.

Match Group Multiples

P/S: 15.46

P/E: 78.58

EV/EBITDA Multiple: 53.14

Unlevered FCF Growth 5yr: 26%

Revenue Growth Expectation 5yr: 20.3%

Bumble Multiples

P/S: 9.8

P/E: 61.74

EV/EBITDA Multiple: 50.56

Unlevered FCF Growth 5yr: 30.6%

Revenue Growth Expectation 5yr: 20.7%

You can see that the two companies actually trade in a relatively similar range, but the one that jumps out is the price to sales ratio as bumble is trading at a discount right now as I would assume it’s because they are not at the same profitability. I think over time though as the company grows, with a software based company they would reach similar operating and ebitda margins if they wanted because their gross margins are exactly the same YTD at 72.2%).

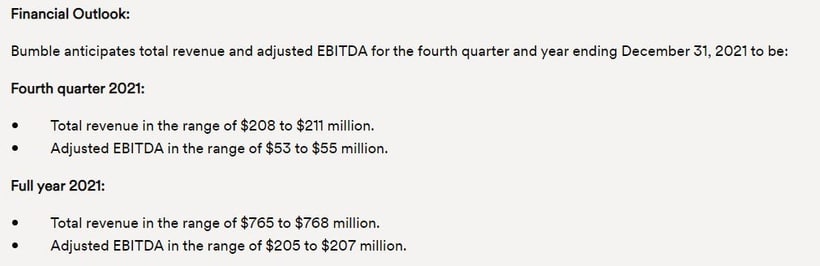

Guidance

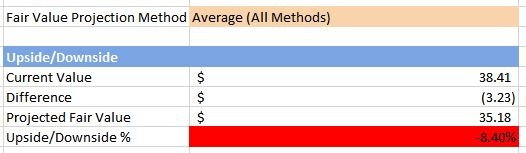

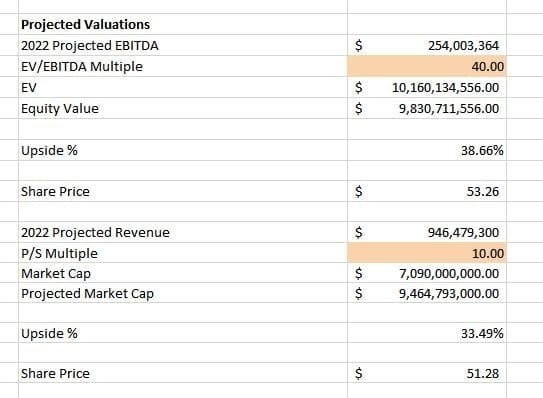

Price Target/Valuation

If I blend the DCF and P/S multiples it looks like BMBL is slightly over fair value, but at the same time if you just look at P/S then it looks about right after this earnings report and cooling off from the IPO hype. Now if you look at the growth rate and the potential for it to keep similar multiples going forward this company is growing and their end of 2022 numbers while maintaining similar multiples for EBITDA & P/S ratio is around +30%.

With these growth stocks trying to nitpick a bottom sometimes bites you, if you have been looking at bumble for a while around this area is much better in my eyes for the long term.

Wall street seems to still like it over the next year. Tipranks is showing around $56.71 as an aggregate target from a year from now based on 7 analysts.

Risks & Ops

For risks I see the potential issue that it’s success is currently based on two flagship products (so if they start to decelerate in growth or market share, that wouldn’t be great for the stock).

They also will always face competition of new apps since there is a lower barrier to entry. In order to battle this they need to keep investing in marketing and make sure to keep users coming back to their platforms instead of competitors (once again it needs the most users to make it the best experience for people using the service).

I see them becoming similar to match.com in which they continue to build out a portfolio of different apps or brands within the space and grow with the overall growth in the online dating addressable market.

I saw that they hinted at taking the metaverse and web 3.0 seriously and figuring out how the company can embrace virtual reality and leverage the blockchain.

Another opportunity for this company is a potential buyout. I am thinking of a company like Facebook could potentially buy them out to get a larger foothold in the dating game or possibly they get bought out by match (which would create a company that has essentially a monopoly on the online dating space).

Conclusion

If I had to chose between bumble or match at current valuations, I would go with bumble if I was going for more upside for the next few years. Match group is the safer bet but does have a little bit of a premium for a stock in the same industry and not necessarily a competitive advantage.

I am not adding the stock to the portfolio quite yet, but it is “on deck” similar to something like Disney with a little bit more growth potential based on the size of the company. I think I’ll nibble around $36 as I have been eyeing this industry for a while.

If you would like to download the DCF excel model, check out the Patreon!