Recession Incoming? One Indicator Is Flashing Signs!

This one little market indicator has predicted pretty much every single recession since 1955. We are talking about the yield curve inverting. You’re probably asking, “what in the world is a yield curve?”.

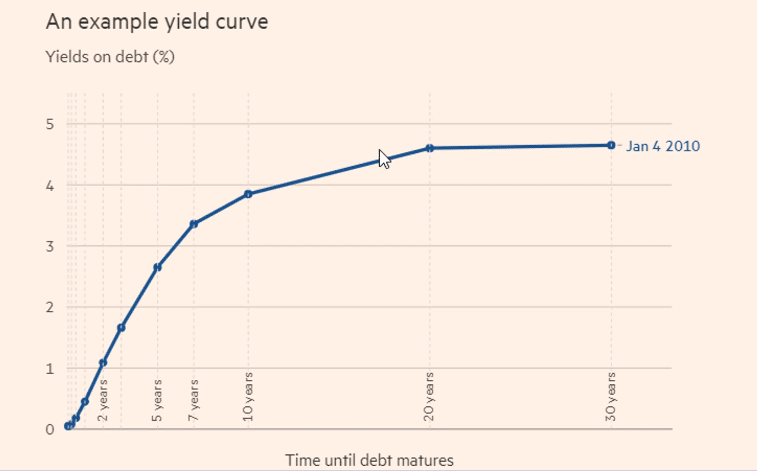

Well, if you look at a financial debt instrument, the higher yield that you get paid, or a percentage of what you lend out, it makes sense that you’d get a higher percentage for longer-term treasuries or bonds (any debt instruments). So the shorter timeframe that you’re lending out the money, the less yield that you’re expecting. The longer timeframe, the higher the yield. What happens is occasionally the shorter-term yields or treasuries become higher than the longer-term treasuries. So if you look at something like the ten year minus the two year, it would make sense that it would be a positive difference because the ten year is a higher rate.

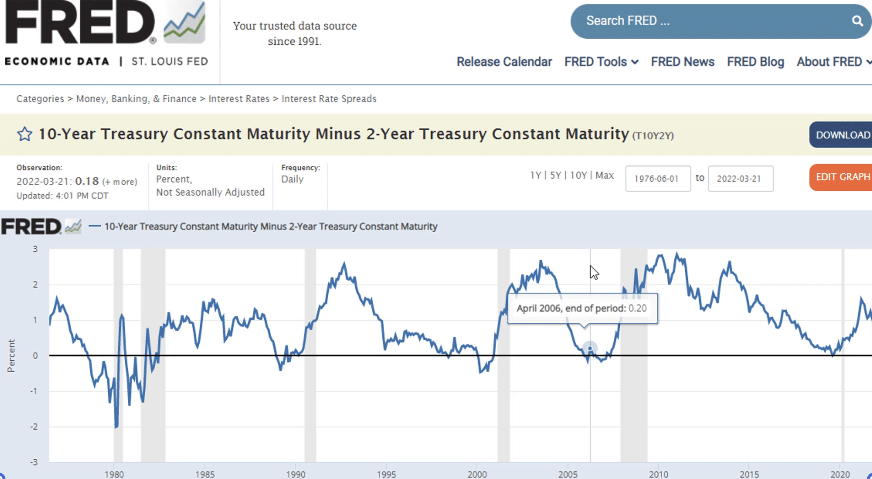

Once in a while, you get that yield curve inverting, meaning that the two year is actually a higher yield than the ten year. Why is that such a big deal? As the short-term yields go up, that means in the short term, investors are thinking that they deserve a higher yield because there may be turbulence in the future or near term future. So instead of an upward curve, you start to see a flattening of the curve. And then eventually you see an inversion where the shorter term is higher than the longer-term rates.

The main takeaway is once the yield curve inverts, there’s usually a recession, a certain period of time after (it’s not right away). After the inversion, anywhere from 9 to 24 months, the actual economy may go into a recession.

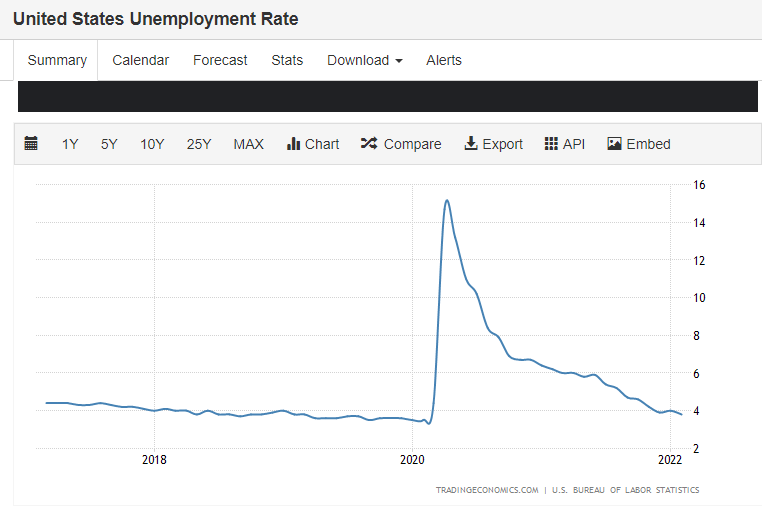

It’s one of those weird situations where you have an economy that is strong right now, you have low unemployment.

The recovery is coming out of COVID. So earnings are higher for a lot of these companies, but at the same time, you have the fed increasing the interest rates in order to combat too high of inflation, because you don’t want runaway inflation, which may set off a domino effect later down the road and may force us into a recession. Now it’s not a hundred percent, but once again, if you look at the past and what happens when the yield curve inverts, well… It may happen.

Of course, the Fed is trying to avoid engineering a recession. Jerome Powell said himself that they’re trying to engineer the perfect soft landing, which means they’re trying to raise rates without going into recession and get inflation under control. Of course, the fed is going to say that! They’re not going to say that they have no idea what’s going on! It is the same Fed that initially said, inflation, wasn’t a problem then it’s “transitory”, okay, it’s a “little elevated”. And then holy crap, it’s too high!

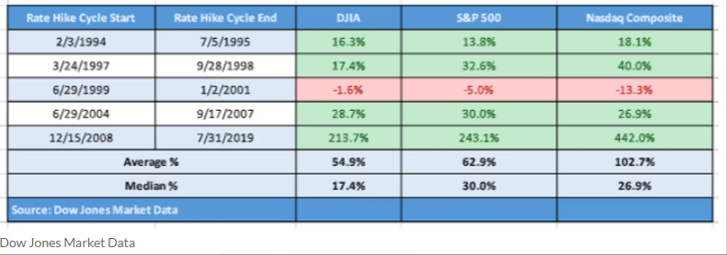

What’s interesting and something I talked about in my free weekly newsletter (check it out here)! Once the rate hike cycle starts, you actually still see a positive average return. And I think this is one of those things where the fed has been indicating that the rate hikes will start a while back. when that happens is when the market actually digests the information and you have a little bit of “sell the rumor buy the news”.

Now back to the yield curve inversion. It still hasn’t happened in 2022. What you’re looking at is the spread of 0.18%. The last time it inverted was in 2019, right? Some people say that’s a little bit lucky or a coincidence because we had COVID, which is more of a Black Swan event. So that one may not have as much weighting as previous times, but we are approaching that yield curve inversion. And it’s something that I think is important to keep an eye on as an investor, to understand how looking at something boring like treasure yields can actually influence your stock investing.

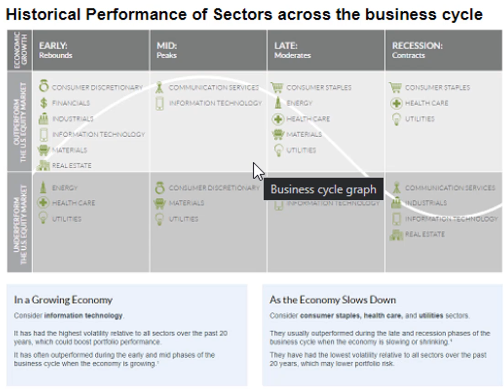

If we look to fidelity for what business cycle we may be in, they have us past the peak in terms of growth stocks when they’re doing their best. We’ve passed that. And we’re going more into the late-cycle, which coincides with that yield curve inverting and possibly signaling a recession may be in the next year.

But as we go into this late-cycle and recession cycle, we can look to some of the stocks that may do well. The more boring, the better! We’re talking about utilities, consumer staples, grocery stores, healthcare, these types of companies that make money, no matter what environment we’re in. These are the types of companies that are going to outperform in recessions, but will probably underperform once we’re back into a growth period.

With the market forward looking and factoring in a possible recession some of these recession-proof stocks have actually done pretty well already this year. The play would have been to move into value 6 months ago… Of course, hindsight is 2020.

I have been buying healthcare stocks over the past five months personally, cause I did want to move a little bit away from growth. Once the whole “inflation may not be transitory” came out of Jerome Powell’s mouth. Again, I’m not the person to over-rotate year to year going all into value or all in on growth. I’m investing in stocks that I still like the valuations, I’m thinking 10 years down the road (with a mix of types of stocks), but if you are focused more on short-term performance, I would not still be going all in to growth quite yet.

Don’t get me wrong. I’ve been nibbling into some growth stocks over the past four months, once in a while. But the majority of my buys have been a little bit more value-focused. Johnson & Johnson (JNJ) was one of the bigger positions I built in Q4. Pfizer (PFE) is one of the names I’ve been building a bigger position in Q1.

What are you guys buying? Do you have recession-proof stocks or are you still all in on growth stocks? Diamond handing no matter what environment we’re going through? Let me know in the comments below if you have recession-proofed your portfolio!

This article was generated from the following Youtube Video: